virginia estimated tax payments due dates 2020

Individual Income Tax Filing Due Dates. If your bank requires authorization for the Department of Taxation to debit a payment from your checking account you must provide them with this.

Members Of Congress Urge Irs To Extend Estimated Tax Deadline Florida Institute Of Cpas

Due dates for 2022 estimated quarterly tax payments.

. See the Estimated Income Tax Worksheet on page 3 of Form 760ES. Pay all business taxes. Virginia Tax is committed to keeping you informed as the Coronavirus COVID-19 crisis continues to evolve.

Please enter your payment details below. - Virginia Tax is reminding taxpayers in Virginia if you havent yet filed your individual income taxes the filing. Extend the due date for certain Virginia income tax payments to June 1 2020 in response to the coronavirus disease 2019 COVID-19 crisis.

Likewise pursuant to Notice 2020-23 the due date for your second estimated tax payment was automatically postponed from June 15 2020 to July 15 2020. Virginia estimated tax payments due dates 2020 Thursday June 16 2022 Edit. Make tax due estimated tax and extension payments.

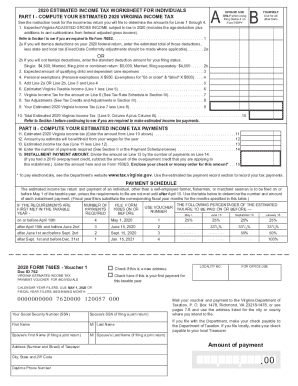

An estimated payment worksheet is available through your individual online services account to help you determine your estimated tax liability and how many payments you should make. Returns are due the 15th day of the 4th month after the close of your fiscal. The due date for certain Virginia income tax payments has been moved to the deadline of June 1 2020.

Under normal circumstances quarterly estimated tax payments for tax year 2020 would have come due April 15 June 15 and September 15 of this year with the final payment. Like tax day quarterly tax payments are due on april 18 this year. FOR IMMEDIATE RELEASE April 18 2022.

However the Virginia extension to pay while penalty-free is not interest-free. If full payment of the. --- 1 - May 1st 2 - June 15th 3 - September 15th 4 - January 15th For additional assistance with the Vouchers please refer to.

You expect to owe at least 1000 in tax for 2020. First estimated income tax payments for TY 2020. If you file your return after March 1 without making the January payment or if you have not paid the proper.

This calculator is for tax year 2021 for taxes filed in. Due to the COVID-19 pandemic the payment deadline was. First and Second Quarter Estimated Individual Income Tax Payment Due Dates.

Make tax due estimated tax and extension payments. Due dates for 2019 Virginia Estimated Tax are. 54 rows In Some States 2020 Estimated Tax Payments Are Due Before 2019 Taxes Are Due.

All income tax payments due between April 1 2020 and June 1 2020 including estimated tax payments due. All income tax payments due between April 1 2020 and June 1 2020 including estimated tax. Virginia announced that the deadline for filing and paying 2020 personal income taxes is extended until may 17 2021.

You can pay all of your estimated. Individual income taxes Corporate income taxes. Publication 926 2020 Household Employer S Tax Guide Internal Revenue Service Tax Guide.

Please refer to Publication 505. Pay bills or set up a payment plan for all individual and business taxes. Virginia estimated tax payments due dates 2020.

Typically most people must file their tax return by May 1. In most cases you must pay estimated tax for 2020 if both of the following apply. Make the estimated tax payment that would normally be due on January 15 2021.

Estimated Tax Payment Due Dates For 2022 Kiplinger

2020 Form Va Dot 760es Fill Online Printable Fillable Blank Pdffiller

Idaho Mississippi And Virginia Are The Holdouts On July 15 Tax Deadlines

/cloudfront-us-east-1.images.arcpublishing.com/gray/TYIIAOOCFJEHJHOBNR3HFW2ZRA.jpg)

Virginia Individual Income Tax Payment Deadline Is June 1

Update Virginia Follows Irs Due Date Move To May 17 Cpa

Va Loan Calculator Us Department Of Veterans Affairs Morgage Calculator

Estimated Income Tax Payments For 2022 And 2023 Pay Online

Knowledge Base Solution How Do I File A Return With July 15th Deadline Using Atx

File Or Extend A Complete List Of 2020 Tax Deadlines Smallbizclub

West Virginia Income Tax Calculator Smartasset

What You Need To Know About The 2022 One Time Tax Rebate Virginia Tax

Billing Information City Of Lynchburg Va

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Irs Not Budging April 15 Is The Deadline For 2021 S First Estimated Tax Payment Don T Mess With Taxes

Irs Tax Refund Calendar 2023 When To Expect My Tax Refund

How To Avoid Estimated Tax Penalties Don T Mess With Taxes

How Estimated Taxes Work Safe Harbor Rule And Due Dates 2021